Renters Insurance in and around Lincoln

Welcome, home & apartment renters of Lincoln!

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Lincoln Nebraska

- Omaha Nebraska

- Hickman Nebraska

- Firth Nebraska

- Eagle Nebraska

- Ashland Nebraska

- Seward Nebraska

- Plattsmouth Nebraska

- Waverly Nebraska

- Syracuse Nebraska

- Unadilla Nebraska

- Bennet Nebraska

- Palmyra Nebraska

- Roca Nebraska

- Milford Nebraska

- Denton Nebraska

- Raymond Nebraska

- Malcolm Nebraska

- Cortland Nebraska

Protecting What You Own In Your Rental Home

The place you call home is the cornerstone for everything you cherish. It’s where you build a life with family and friends. Home is truly where your heart is. That’s why, even if you live in a rented condo or apartment, you should have renters insurance—especially if you own items that would be difficult to fix or replace. It's coverage for the things you do own, like your children's toys and guitar... even your security blanket. You'll get that with renters insurance from State Farm. Agent Gerit Schell can roll out the welcome mat with the knowledge and competence to help you make sure your stuff is protected. Attentive care and service like this is what sets State Farm apart from the rest. When you're covered by State Farm, your rental can be home sweet home.

Welcome, home & apartment renters of Lincoln!

Renters insurance can help protect your belongings

Agent Gerit Schell, At Your Service

It's likely that your landlord's insurance only covers the structure of the condo or home you're renting. So, if you want to protect your valuables - such as a bedding set, a dining room set or a bicycle - renters insurance is what you're looking for. State Farm agent Gerit Schell is dedicated to helping you understand your coverage options and protect yourself from the unexpected.

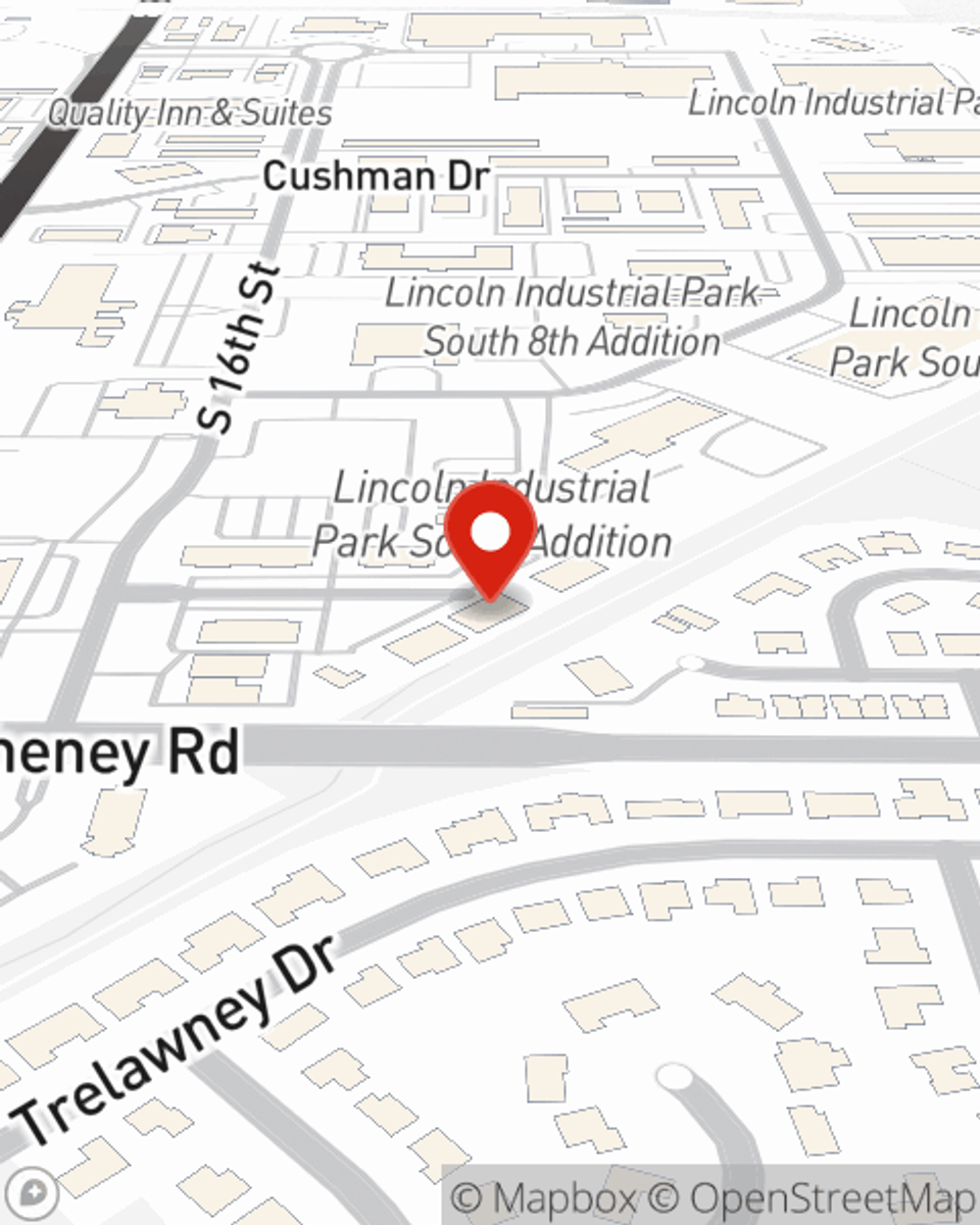

A good next step when renting a condominium in Lincoln, NE is to make sure that you're properly protected. That's why you should consider renters coverage options from State Farm! Call or go online today and learn more about how State Farm agent Gerit Schell can help meet your renters insurance needs.

Have More Questions About Renters Insurance?

Call Gerit at (402) 475-2345 or visit our FAQ page.

Simple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Gerit Schell

State Farm® Insurance AgentSimple Insights®

Portable moving pods: A new approach to moving

Portable moving pods: A new approach to moving

Portable moving pods can offer new advantages for the moving process. Decide what’s easiest and cheapest for you.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.